The valuation of startups is a complex and often debated topic in the business world. Unlike established companies with steady cash flows and well-documented histories, startups operate in an environment of uncertainty. They may have little to no revenue, limited assets, and an unproven business model. Yet, the valuation of these companies is crucial for attracting investment, determining equity shares, and guiding strategic decisions. This article delves into the key aspects of startup valuation, exploring the methods, challenges, and factors that influence the process.

Valuation is essential for several reasons:

- Raising Capital: Startups need to present a valuation to attract investors. This valuation helps in negotiating equity stakes.

- Mergers and Acquisitions: Valuation is critical in determining the worth of a startup during mergers or acquisitions.

- Employee Stock Options: Startups often use stock options as part of compensation packages. The valuation helps in determining the price of these options.

- Strategic Planning: A clear understanding of a startup’s value aids in making informed business decisions and setting long-term goals.

Startup Valuation Methods

Discounted Cash flow Method

Discounted Cash Flow (DCF) is a traditional method where future cash flows are projected and then discounted back to their present value using a discount rate. Present value of cash flows till perpetuity (over long term) is the intrinsic value of the Company.

For startups, the difficulty lies in accurately forecasting future cash flows and selecting an appropriate discount rate. The DCF method is very subjective and sensitive to assumptions and depends on the following factors (not exhaustive).

- Experience of the Founders in the respective field..

- Novelty of the business idea.

- Stage of the operations (Revenue, profitability and cash flows)

- Perception of the investor.

Market Based Approach

Market Based method or Relative Valuation approach involves comparing the startup with similar companies that have recently been valued or sold. By looking at metrics like revenue multiples, profit multiples, and market capitalization, investors can estimate the startup’s value.

However, there could be multiple challenges using this method.

- It is difficult to find comparable companies and recent transactions

- Operating metrics like EBITDA, EBIT, Net income etc are not available. In some cases, even revenue might not be available.

Venture Capital Method

This method is popular among venture capitalists for valuing startups, particularly during early stage investments. This method is straightforward and is based on estimating the value of a company at the time of exit (typically through an IPO or acquisition) and then working backward to determine the current valuation.

The VC Method is simple and quick, making it a popular choice for early-stage valuations.

Example

A startup is projected to be worth $50 million in 5 years. A VC is interested in investing and requires a 5x return on investment.

- Exit Value: $50 million

- Required Return: 5x

- Post-Money Valuation: $50 million / 5 = $10 million

- Investment Amount: $3 million

- Pre-Money Valuation: $10 million – $3 million = $7 million

- Equity Stake: $3 million / $10 million = 30%

Thus, the VC would invest $3 million for a 30% equity stake in the company.

Limitations

- The VC Method relies heavily on assumptions about future performance, exit multiples, and required returns. If these assumptions are off, the valuation can be significantly inaccurate.

- VCs typically seek high returns, so the method often results in low valuations compared to other methods.

This method is particularly useful when there is a lot of uncertainty, and more precise valuation methods are difficult to apply.

First Chicago Method

The First Chicago Method is a valuation technique primarily used for valuing startups and high-risk companies, particularly when there’s uncertainty about future cash flows. This method combines elements of both scenario analysis and discounted cash flow (DCF) to provide a more nuanced valuation.

It is a scenario based valuation approach and generally considers 3 scenarios – Best case, Base Case and Worst Case. Each scenario represents different potential outcomes for the company’s future performance.

Best Case – The startup experiences rapid growth, leading to a high terminal value.

Base Case: The startup grows at a steady but moderate rate.

Worst Case: The startup grows at a low rate with low margins or even losses. This scenario has a lower terminal value. This scenario may also assume the value of the startup in case of failure.

The final valuation is a weighted average of the present values from each scenario. The formula looks like this:

Valuation = (PV of Best Case × Probability of Best Case) + (PV of Base Case × Probability of Base Case) + (PV of Worst Case × Probability of Worst Case)

This method allows for the consideration of multiple possible futures, which is particularly useful for startups with uncertain outcomes. Also by incorporating different scenarios, investors can better manage and understand the risks involved.

This method is particularly favored by venture capitalists and private equity investors, as it provides a more comprehensive picture of a startup’s potential value under various conditions.

Scorecard Method

The scorecard method is used primarily in the early stages. This method involves comparing the startup to other similar startups (comparable companies) and adjusting the valuation based on various factors. It involves assigning weights to various qualitative and quantitative factors, such as the management team, market opportunity, product stage, and competition etc.

This method involves the following steps-

- Determine the Average Pre-Money Valuation for Similar Startups.

- Identification of key factors and their weights

- Assigning scores to each factor and calculation of the weighted score to determine the startup valuation

Example

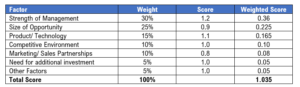

Suppose the average pre-money valuation for similar startups is $3 million. The startup in question has been evaluated and the following scores are assigned:

- The total score is 1.035.

- The estimated pre-money valuation of the startup would be 1.035 * $3 million = $3.105 million.

This method provides a systematic way to adjust a startup’s valuation based on qualitative factors, which are crucial in the early stages.

Berkus Method

The Berkus Method is a startup valuation approach designed to estimate the value of early-stage companies, particularly those that have little to no revenue or are still in the idea or development phase. Developed by angel investor Dave Berkus, this method assigns value to a startup based on key qualitative factors rather than traditional financial metrics like revenue or profit, which might not be available for early-stage ventures.

- The Berkus Method assumes that the maximum value of the pre revenue startup could be $2M.

- The second question it considers is whether the startup can reach to $20M revenue by the 5th year of business.

- If the answer is Yes then the business is assessed against these 5 criterias. All these 5 criterias are assigned equal weights for the startup valuation.

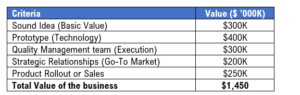

- Sound Idea (Basic Value): Assigns value to the basic idea behind the startup, provided it’s feasible and solves a real problem.

- Prototype (Reducing Technology Risk): Considers the development of a prototype or working model that reduces the technology risk.

- Quality Management Team (Reducing Execution Risk): Evaluates the strength and experience of the management team, as this is critical to execution.

- Strategic Relationships (Reducing Market Risk): Assesses the startup’s strategic partnerships or customer base that can help penetrate the market.

- Product Rollout or Sales (Reducing Production Risk): Looks at initial traction, such as product rollouts or early sales, which reduce production and operational risks.

Example

The Pre money valuation based on Berkus Method is $1.45M in this example.

Risk Factor Summation Method

The Risk Summation Factor Method is a technique often used to value startups, especially in early-stage investments where traditional valuation methods might not be suitable due to the lack of historical financial data. This method involves assigning values to various risk factors associated with the startup and summing them to arrive at a valuation.

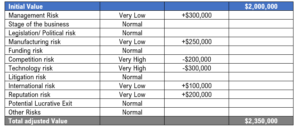

In the Risk Factor Summation Method, start with a base value or a baseline valuation for the startup. This could be derived from the cost approach, market comparisons, or any other standard valuation technique.

Identify key risk factors that could impact the startup’s success. Common risk factors include: Management risk, Stage of business, Political/Litigation risk, Technology risk, product risk, market risk etc.

Each identified risk factor is assigned a premium or discount based on the perceived level of risk. The risk premiums or discounts are then added to (or subtracted from) the base value. This adjustment reflects the aggregate impact of the various risks on the startup’s valuation.

After summing the risk-adjusted premiums and discounts, the final valuation of the startup is obtained.

Example

While this method provides a structured approach to account for uncertainties in early-stage ventures, it is very subjective as the assignment of risk premiums depends on the investor’s judgment.

This method is often used in conjunction with other valuation techniques to provide a more comprehensive view of a startup’s worth.

Challenges in Valuing Startups

Valuing a startup is particularly challenging due to several factors:

- Lack of Historical Data: Startups often lack the financial history that traditional valuation models (Discounted cash flow Method, Market based method) rely on.

- Uncertainty of Future Cash Flows: Predicting future revenues and profits can be highly speculative, especially for early-stage startups.

- Market Volatility: Startups operate in dynamic markets, where trends and consumer preferences can change rapidly, impacting the business model.

- Subjectivity: Valuation often involves subjective judgment, leading to different valuations by different investors.

Valuing a startup is both an art and a science. It requires a deep understanding of the business, market, and financial principles, along with the ability to make informed assumptions about the future. While there is no one-size-fits-all approach to startup valuation, using a combination of methods and considering various factors can lead to a more accurate and fair assessment. Ultimately, a well-justified valuation is essential for securing investment and driving the startup toward long-term success.