Payback period is used to evaluate the time it takes for an investment to recover its initial cost. It serves as a pivotal tool for businesses and investors alike, aiding in decision-making processes by providing insights into the feasibility and profitability of potential ventures. In this article, we delve into the essence of payback period, its calculation, utility, as well as its advantages and limitations.

What is Payback Period?

The payback period is a financial metric used by businesses to evaluate the time it takes to recover the initial investment in a project or investment. It’s a straightforward measure that considers cash flows and the time it takes to recoup the initial investment. In simpler terms, it signifies how long it takes for an investor to “get their money back” from a particular investment.

Understanding the payback period is crucial for Capital budgeting to make informed decisions about investments, as it provides insights into the liquidity and risk associated with a project or investment opportunity.

How is Payback Period Calculated?

Calculating the payback period involves two main steps:

- Identify Cash Flows: First, determine the cash flows associated with the investment. These cash flows typically include the initial investment and the net cash inflows generated by the investment over time. Net cash inflows are calculated by subtracting any cash outflows from cash inflows in each period.

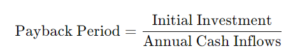

- Calculate the Payback Period: Once you have the cash flows identified, calculating the payback period is simple. It’s the time it takes for the cumulative cash inflows to equal the initial investment. You can calculate it using the formula:

Calculating the payback period involves a straightforward approach, particularly for investments with consistent cash flows. However, when cash flows are irregular or vary over time, the calculation becomes more intricate. In such cases, the payback period is determined by summing up the cash flows until the initial investment is recovered.

Example:

Let’s consider a project with an initial investment of $30,000 and expected annual cash inflows of $10,000.

- Year 1: $10,000

- Year 2: $10,000

- Year 3: $10,000

- Year 4: $10,000

- Year 5: $10,000

Payback Period = Initial Investment/ Annual cash Inflows

Payback Period = $30,000 / $10,000 per year = 3 years

So, in this example, the payback period for the project is 5 years.

Applicability of Payback period

- Quick Assessment of Risk: Payback period provides a quick assessment of how long it will take to recoup the initial investment, helping businesses gauge the risk associated with an investment.

- Comparison Tool: It allows businesses to compare multiple investment opportunities by assessing their payback periods, aiding in decision-making.

- Cash flow Management: Payback period helps in evaluating the liquidity impact of an investment by considering how soon cash inflows will offset the initial outlay. The payback period assists in planning financial strategies and ensuring liquidity.

Advantages of Payback period

The payback period is a simple yet effective financial metric that offers several advantages, making it a valuable tool for businesses in decision-making processes. Some of the key advantages of using the payback period include:

- Simplicity and Ease of Understanding: One of the primary advantages of the payback period is its simplicity. It involves basic arithmetic calculations that are easy to understand, even for individuals without extensive financial training. This simplicity makes it accessible to a wide range of stakeholders within an organization, facilitating communication and consensus building in investment decisions.

- Quick Assessment of Risk: The payback period provides a quick assessment of the risk associated with an investment. By indicating the time it takes to recover the initial investment, it offers insights into the project’s liquidity and the level of uncertainty regarding future cash flows. Projects with shorter payback periods are generally perceived as less risky since they allow for quicker capital recovery.

- Focus on Liquidity: Unlike other financial metrics that may focus solely on profitability or return on investment, the payback period emphasizes liquidity. It helps businesses evaluate how soon they can recoup the initial investment, which is particularly important for companies with limited cash resources. By considering the timing of cash inflows and outflows, the payback period assists in managing cash flow and working capital effectively.

- Useful for Capital Budgeting: The payback period is commonly used in capital budgeting decisions, especially for evaluating investments in fixed assets or capital projects. It provides a quick screening mechanism for identifying potentially viable investment opportunities. Businesses can use the payback period to prioritize projects and allocate resources efficiently based on their expected payback periods.

- Comparison Tool: Another advantage of the payback period is its utility as a comparative tool. Businesses can use it to compare multiple investment options and prioritize them based on their respective payback periods. By assessing the relative risk and liquidity implications of different projects, organizations can make more informed investment decisions and allocate capital to projects with shorter payback periods or higher returns.

- Encourages Conservative Investment Decisions: Since the payback period focuses on recovering the initial investment, it encourages conservative investment decisions that prioritize shorter payback periods. This can help mitigate risk and ensure that resources are allocated to projects with more predictable cash flows and quicker returns. Additionally, a shorter payback period may align with the organization’s strategic objectives and financial goals by promoting agility and responsiveness to market changes.

Limitations of Payback Period

The payback period is a useful tool for assessing investment opportunities, but it comes with its own set of limitations. Here are some of the key limitations of using the payback period:

- Ignores Time Value of Money: The payback period does not consider the time value of money, meaning it treats cash flows received in the future the same as those received today. This can lead to inaccuracies in evaluating investments, especially when comparing projects with different cash flow timings or discount rates.

- Ignores Cash Flows Beyond Payback Period: The payback period focuses solely on the time it takes to recoup the initial investment and does not take into account cash flows beyond the payback period. As a result, it may overlook the long-term profitability of an investment or project.

- Subjectivity in Setting Payback Period Thresholds: Different businesses may have different criteria for an acceptable payback period based on factors such as risk tolerance, opportunity cost, and financing constraints. Setting arbitrary payback period thresholds can lead to biased decision-making and missed opportunities.

- Excludes Non-Cash Factors: The payback period does not consider non-cash factors such as depreciation, taxes, and inflation, which are important considerations in investment analysis. Ignoring these factors can result in an incomplete assessment of the true financial impact of an investment.

- Bias towards Short-Term Projects: The payback period tends to favor projects with shorter payback periods, as they are perceived to be less risky and more liquid. This bias may lead businesses to prioritize short-term projects over potentially more profitable long-term investments.

- Limited Focus on Profitability: While the payback period provides insights into the liquidity and risk of an investment, it does not directly measure profitability. As a result, it may not be suitable for evaluating projects where profitability is the primary objective.

Despite these limitations, the payback period remains a valuable tool for initial screening of investment opportunities, especially for businesses with limited resources or a need for quick decision-making. However, it should be used in conjunction with other financial metrics and qualitative factors to make well-informed investment decisions.