What is Net Present Value (NPV)?

Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or project. It represents the difference between the present value of cash inflows and outflows over a specific period. In essence, NPV measures how much value an investment will generate compared to its initial cost, accounting for the time value of money.

The concept of NPV is based on the principle that a dollar received in the future is worth less than a dollar received today due to the opportunity cost of not having that money available for investment or consumption immediately. Therefore, NPV adjusts future cash flows to their present value by discounting them using a predetermined discount rate.

Net Present Value = Present Value of Cash Inflows (-) Present Value of Cash Outflows

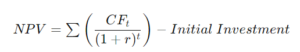

The formula for calculating NPV is:

Where:

- CFt represents the cash flow at time t,

- r is the discount rate,

- t is the time period, and

- Initial Investment denotes the upfront cost to initiate the project.

To calculate NPV, you discount each future cash flow back to its present value using the discount rate, and then sum up all these present values. The result gives you the net value in today’s terms.

- If the NPV is positive, it indicates that the investment is expected to generate value and is considered desirable.

- A negative NPV suggests that the investment is likely to result in a loss and may not be worthwhile. A zero NPV means that the investment is expected to yield exactly enough returns to cover the initial investment, without generating any excess value.

- NPV is widely used in various financial decision-making processes, including capital budgeting, investment analysis, and project evaluation. It provides a systematic approach for comparing different investment opportunities by considering their potential returns and risks in today’s terms.

- Overall, Net Present Value is a crucial tool in finance, helping investors and businesses make informed decisions about allocating resources and determining the profitability of potential investments.

Example:

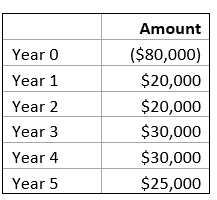

XYZ Inc. is considering investment of $80,000 in a manufacturing facility. The project is expected to generate cash flows for 5 years as follows.

At the end of the 5th year the manufacturing facility can be sold off for $15,000/-. Cost of capital is 10%. You are asked to evaluate the project.

NPV = PV of cash inflows (-) PV of cash outflows.

Present Value = Future Value/(1+r)^t

Where;

- Future value = future cash flows

- r = Cost of capital or discount rate

- n = Time period

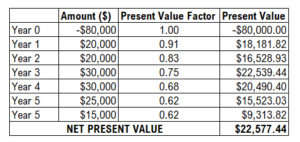

For year 1 cash flows, Present Value = 20,000/(1+10%)^1 = $18,181.82

For year 2 cash flows, Present Value = 20,000/(1+10%)^2 = $16,528.93

For year 3 cash flows, Present Value = 30,000/(1+10%)^2 = $22,539.44

For year 4 cash flows, Present Value = 30,000/(1+10%)^2 = $20,490.40

Year 5 cash flows = Cash flows from the business + Terminal Value = ($25000+$15,000) =$40,000/-

For year 5 cash flows, Present Value = 40,000/(1+10%)^2 = $24,836.85

Present value of cash inflows = $18,181.82 + $16,528.93 + $22.539.44 + $20,490.40 + $24,836.85 = $102,577.44

Initial investment = $80,000

NPV = $102,577.44 – $80,000 = $22,577.44

The Net Present Value for the project is positive $22,577. It is value creating and should be accepted.

Advantages of Using NPV

Net Present Value (NPV) offers several advantages in financial decision-making due to its comprehensive evaluation of investments. Some of the key advantages include:

- Considers Time Value of Money: NPV takes into account the time value of money, recognizing that a dollar received today is worth more than a dollar received in the future. By discounting future cash flows to their present value, NPV provides a more accurate assessment of the true profitability of an investment.

- Provides a Clear Decision Criterion: NPV offers a clear decision criterion for evaluating investment opportunities. If the NPV is positive, it indicates that the investment is expected to generate value and increase the wealth of the investor. Conversely, a negative NPV suggests that the investment is likely to result in a loss. This makes it easier for decision-makers to determine whether an investment is financially viable.

- Accounts for Risk: NPV allows for the incorporation of risk by adjusting the discount rate according to the perceived riskiness of the investment. This enables decision-makers to account for uncertainties and make more informed decisions in situations where investments carry varying levels of risk.

- Facilitates Comparison of Investments: NPV provides a standardized measure that allows for the comparison of different investment opportunities. By calculating the NPV of various projects or investments, decision-makers can prioritize those with the highest NPV, thereby maximizing the overall return on investment.

- Flexible and Customizable: NPV is a flexible tool that can accommodate different cash flow scenarios and discount rates. This flexibility allows decision-makers to tailor the analysis to specific circumstances and adjust parameters as needed to account for changing market conditions or investment objectives.

- Considers the Entire Cash Flow Stream: NPV considers the entire cash flow stream associated with an investment, including both inflows and outflows over the project’s life. This comprehensive approach ensures that all relevant costs and benefits are taken into account, leading to more accurate investment decisions.

- Promotes Long-Term Value Creation: By focusing on the net value generated over the entire life of an investment, NPV encourages decision-makers to prioritize investments that contribute to long-term value creation rather than short-term gains. This can lead to more sustainable and profitable investment strategies over time.

Net Present Value is a powerful tool that offers numerous advantages in evaluating investment opportunities. By considering the time value of money, providing a clear decision criterion, accounting for risk, facilitating comparisons, and promoting long-term value creation, NPV helps investors and businesses make more informed and financially sound decisions.

Limitations of Using NPV

While Net Present Value (NPV) is a widely used and powerful tool for investment analysis, it also has several limitations that should be considered:

- Reliance on Estimates: NPV calculations heavily rely on estimates of future cash flows and the discount rate. These estimates may not always be accurate, leading to potential errors in the NPV calculation and resulting in flawed investment decisions.

- Difficulty in Estimating Discount Rate: Determining the appropriate discount rate to use in NPV calculations can be challenging. The discount rate should reflect the riskiness of the investment, but assessing risk accurately is subjective and may vary among investors or analysts. Using an incorrect discount rate can significantly impact the NPV calculation and lead to misleading results.

- Assumes Reinvestment at Discount Rate: NPV assumes that all cash flows generated by the investment can be reinvested at the discount rate used in the calculation. However, this may not always be realistic, especially in situations where the investment opportunities available for reinvestment differ from the original project.

- Does Not Account for Non-Monetary Factors: NPV only considers the financial aspects of an investment and does not account for non-monetary factors such as environmental impact, social considerations, or strategic alignment with organizational goals. Ignoring these factors may lead to investments that are not aligned with broader objectives or values.

- Limited in Comparing Projects with Different Sizes or Durations: When comparing projects with different sizes or durations, NPV alone may not provide sufficient insight. In such cases, other metrics such as the profitability index or internal rate of return (IRR) may complement NPV analysis to provide a more comprehensive evaluation.

Despite these limitations, NPV remains a valuable tool for investment analysis. However, it is essential to recognize its constraints and use NPV in conjunction with other financial metrics and qualitative considerations to make well-informed investment decisions.

Pingback: Understanding Internal Rate of Return (IRR) in Financial Analysis - corpfinanceinsights.com

Pingback: Understanding Capital Budgeting Techniques: A Guide to Effective Decision-Making - corpfinanceinsights.com