In the realm of financial analysis, metrics play a crucial role in evaluating investment opportunities. One such metric that holds significant importance is the Internal Rate of Return (IRR). IRR serves as a yardstick for assessing the potential profitability of an investment or project. In this article, we will delve into what IRR entails, provide examples to illustrate its application, and discuss its advantages and limitations.

What is Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR) is a financial metric used to determine the profitability of an investment over a specific period. It represents the discount rate at which the net present value (NPV) of all cash inflows and outflows from the investment equals zero. In simpler terms, IRR signifies the rate of return that an investment is expected to generate based on its projected cash flows.

Calculation of Internal Rate of Return

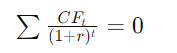

To calculate the IRR, one needs to estimate the future cash flows associated with the investment and discount them back to their present value using a discount rate. The discount rate is typically the minimum rate of return required by investors or the cost of capital for the project. The IRR is the rate at which the sum of the present values of cash inflows equals the sum of the present values of cash outflows. Mathematically, it can be expressed as follows:

Where:

- CFt represents the cash flow at time t,

- r is the internal rate of return,

- t is the time period.

Example Illustrating IRR Calculation:

Consider a hypothetical project with an initial investment of $100,000. The projected cash flows for the next five years are as follows:

- Year 1: $30,000

- Year 2: $40,000

- Year 3: $25,000

- Year 4: $20,000

- Year 5: $15,000

Using the IRR formula, we can calculate the discount rate that equates the present value of these cash flows to the initial investment. Utilizing excel or iterative methods, the IRR for this project is found to be approximately 12%.

Advantages of using IRR

Using the Internal Rate of Return (IRR) offers several advantages in financial analysis and decision-making processes. These advantages include:

- Single Metric for Evaluation: IRR provides a single metric that summarizes the attractiveness of an investment opportunity. Instead of analysing multiple figures, stakeholders can rely on the IRR to assess the project’s potential return.

- Incorporation of Time Value of Money: By discounting future cash flows back to their present value, IRR accounts for the time value of money. This ensures that cash flows occurring at different points in time are compared on a consistent basis, providing a more accurate assessment of the investment’s profitability.

- Comprehensive View of Cash Flows: IRR considers the entire cash flow stream of a project, encompassing both inflows and outflows over its lifespan. This comprehensive perspective enables decision-makers to evaluate the project’s overall financial performance and assess its long-term sustainability.

- Standardized Comparison Tool: IRR serves as a standardized metric for comparing different investment opportunities. By comparing the IRRs of multiple projects, investors can prioritize those with higher expected returns relative to their risk, facilitating more informed decision-making.

- Alignment with Investor’s Expectations: IRR helps align investment decisions with the expectations of investors. By calculating the rate of return that the project is expected to generate, stakeholders can determine whether the investment meets their desired level of profitability and risk tolerance.

- Flexibility in Capital Budgeting: IRR can be utilized in capital budgeting decisions to determine the feasibility of investing in new projects or expanding existing operations. By comparing the IRR of a project to the company’s cost of capital or hurdle rate, management can assess its potential impact on shareholder value and prioritize capital allocation accordingly.

- Sensitive to Timing of Cash Flows: IRR takes into account the timing of cash flows, giving more weight to those occurring earlier in the project’s lifespan. This sensitivity to timing is particularly beneficial in situations where the timing of cash flows significantly influences the project’s overall profitability, such as in real estate development or infrastructure projects.

- Ease of Interpretation: IRR is relatively easy to interpret, making it accessible to a wide range of stakeholders, including investors, managers, and financial analysts. Its intuitive nature allows decision-makers to quickly grasp the project’s potential return and make informed judgments regarding investment opportunities.

Overall, the advantages of using IRR make it a valuable tool in financial analysis, enabling stakeholders to assess the profitability, viability, and risk of investment projects with greater confidence and precision.

Limitations of IRR

- Assumption of Reinvestment at IRR: One limitation of IRR is its assumption that all cash flows are reinvested at the calculated internal rate of return. In reality, reinvestment rates may vary, leading to potential inaccuracies in the assessment of actual returns.

- Difficulty with Non-Conventional Cash Flows: IRR may encounter challenges when dealing with projects that involve non-conventional cash flows, such as multiple changes in cash flow direction. In such cases, the calculation of IRR becomes complex and may yield ambiguous results.

- Unrealistic IRR in Certain Scenarios: In some scenarios, particularly where cash flows exhibit irregular patterns or extreme fluctuations, IRR may yield unrealistic or misleading results. This can occur when there are multiple IRRs or when the IRR exceeds the cost of capital by a significant margin.

- Inability to Account for Scale Differences: IRR does not consider the scale or size of the investment, which can be problematic when comparing projects of varying sizes. A project with a higher IRR may not necessarily be more financially beneficial if it requires a substantially larger initial investment.

- Dependency on Cash Flow Estimates: The accuracy of IRR calculations relies heavily on the accuracy of cash flow estimates and assumptions used in the analysis. Small variations in projected cash flows can result in significant changes in the calculated IRR, potentially leading to unreliable conclusions regarding the project’s profitability.

- Does Not Consider Project Duration: IRR does not provide any information about the duration or timeline of the project’s cash flows. As a result, projects with similar IRRs may have different durations, which can impact their overall financial risk and feasibility.

Overall, while IRR is a valuable tool for evaluating investment opportunities, it is essential to recognize its limitations and use it in conjunction with other financial metrics and qualitative factors to make well-informed investment decisions.