Total Shareholder Return (TSR) is a vital metric used by investors to evaluate the performance of a stock or investment over a specific period. It provides a comprehensive view of the overall return generated by an investment, encompassing both capital gains (or losses) and dividends received by shareholders. Understanding how TSR is measured and calculated is essential for investors seeking to assess the true value of their investments.

What is Total Shareholders Return?

TSR, or Total Shareholder Return, measures the total value that an investor has received from holding a particular investment over a given period. It takes into account two main components:

- Capital Gains (or Losses): Capital Gains (or losses) are the changes in the market price of the investment over the specified time frame. Capital gains occur when the market value of the investment increases, resulting in a profit for the investor. Conversely, capital losses occur when the market value decreases, leading to a decrease in the investment’s value.

- Dividends: Dividends are periodic payments made by companies to their shareholders as a distribution of profits. They represent a portion of the company’s earnings and are typically paid in cash or additional shares of stock. Including dividends in the calculation of TSR provides a more accurate reflection of the total return generated by the investment.

Total Shareholders Return calculation

The formula for calculating TSR is straightforward and involves two main steps:

Step 1: Calculate the Capital Gain (or Loss) Component: To calculate the capital gain component of TSR, you need to determine the change in the market price of the investment over the holding period. The formula for capital gain is:

![]()

Step 2: Include Dividends: Once you’ve calculated the capital gain component, you need to incorporate dividends into the calculation. To do this, add the total dividends received per share to the capital gain. The formula for TSR including dividends is:

TSR = Capital Gain+Dividends

Example 1: When the investing period is <=1 year

Let’s consider an example to illustrate how TSR is calculated:

- Initial market price per share: $50

- Current market price per share: $60

- Dividends per share: $2

- Holding period: 1 year

Step 1: Calculate the Capital Gain Component:

Capital Gain = (60 – 50)/50 = 20%

Step 2: Include Dividends:

TSR = Capital Gain+Dividends=20%+(2/50)×100=24%

Example 2: When the investing period is >1 year and there is no dividend

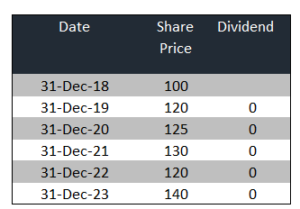

Investors often seek to evaluate the performance of their investments over specific timeframes to assess their returns and make informed decisions. In this case study, we’ll explore how John, an investor, can calculate the annual returns earned from owning shares in ABC Limited over a five-year period from December 31, 2018, to December 31, 2023. While ABC Limited has not paid any dividends during this period, we’ll focus on the changes in the share price to determine John’s returns.

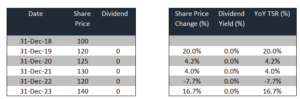

To calculate TSR, when the holding period of the investment is more than 1 year, first calculate the annual Capital appreciation. It is calculated as change in share price divided by share price at the beginning of the period.

![]()

For example, Capital appreciation in 2019 = (120-100)/100 = 20%,

Dividend is 0 in our example, hence total TSR for 2019 is 20%

The annual share price appreciation and dividend yield for all the years is shown in the below table. Total TSR in this example, is equal to the share price change.

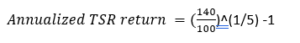

Annualised TSR can be calculated in 2 ways;

Calculate Annualised TSR using the following formula

![]()

n = Total no of years

= 7%

= 7%

In the second method, we can calculated the annualized return by using the Geomean function in excel.

To calculate Geomean, type =Geomean(1+(YoY return range))-1

Then press, Control + Shift + Enter (Since it is an array function). You get the same answer. TSR = 7%.

Total Shareholder Return (TSR) provides investors with a comprehensive measure of the overall return generated by an investment, considering both capital gains and dividends. By understanding how TSR is calculated and incorporating it into their investment analysis, investors can make more informed decisions and assess the true value of their investments over time.