Investing in financial markets inherently involves a certain level of risk. Among the various types of risk, systematic and unsystematic risks are two fundamental concepts that investors need to grasp in order to make informed investment decisions. These risks play a crucial role in determining the performance and volatility of an investment portfolio.

Systematic Risk

Systematic risk, also known as market risk or undiversifiable risk, is the type of risk that is inherent in the entire market or a specific segment of the market. It is caused by factors that are external to the individual investment being considered and affects all investments to some degree. Systematic risk cannot be diversified away by holding a diversified portfolio of assets because it is related to broad market factors that impact the overall economy.

Here are some examples of systematic risk:

- Interest Rate Risk: Changes in interest rates by central banks or monetary authorities can have a significant impact on various sectors of the economy. For example, when interest rates rise, borrowing costs increase, leading to lower consumer spending and reduced business investment. This affects the profitability and stock prices of companies across multiple industries.

- Inflation Risk: Inflation erodes the time value of money. High inflation rates can lead to increased production costs for companies, reduced consumer purchasing power, and lower real returns on investments. Investors face the risk of their investment returns being diminished by inflationary pressures.

- Economic Recession: Economic downturns or recessions are periods of negative economic growth characterized by declining GDP, rising unemployment, and reduced consumer spending. During a recession, corporate earnings typically decline, leading to lower stock prices across various sectors of the economy. The 2008 financial crisis is a notable example of how a systemic economic downturn can cause widespread market turmoil and asset value depreciation.

- Political and Geopolitical Events: Political instability, changes in government policies, or geopolitical tensions can disrupt financial markets and investor sentiment. For instance, uncertainty surrounding trade agreements between countries or conflicts in geopolitically sensitive regions can lead to increased volatility in global financial markets.

- Natural Disasters: Events such as earthquakes, hurricanes, or pandemics can have profound impacts on economies and financial markets. These events can disrupt supply chains, damage infrastructure, and lead to significant economic losses, affecting companies’ profitability and investor confidence.

Unsystematic Risk

Unsystematic risk, also known as specific risk or diversifiable risk, is the type of risk that is specific to a particular company, industry, or asset. Unlike systematic risk, which affects the entire market or a specific segment of the market, unsystematic risk can be mitigated through diversification because it is unrelated to broad market factors.

Here are some examples of unsystematic risk:

- Company-specific Risk: Risks that are specific to a particular company, such as management changes, product recalls, or litigation. For instance, if a company’s CEO resigns unexpectedly, it may lead to uncertainty about the company’s future direction and negatively impact investor confidence, resulting in a decline in the company’s stock price.

- Industry-specific Risk: Risks that are unique to a particular industry or sector, such as changes in consumer preferences, technological advancements, or regulatory changes affecting only a specific industry. For example, if a new competitor enters the market with a disruptive technology, it may pose a threat to existing companies within the same industry, leading to a decrease in their market share and profitability.

- Financial Risk: Risks related to a company’s financial structure or position, such as high levels of debt, liquidity problems, or accounting scandals. For instance, if a company relies heavily on debt financing and interest rates rise, it may face higher borrowing costs, potentially impacting its profitability and stock price.

- Supply Chain Risk: Risks associated with disruptions in the supply chain, such as raw material shortages, transportation delays, or production bottlenecks. For example, if a company’s primary supplier experiences production delays due to labor strikes, it may lead to inventory shortages and hinder the company’s ability to meet customer demand, affecting its revenue and profitability.

- Regulatory Risk: Risks arising from changes in government regulations or policies that impact specific industries or companies. For instance, if a government imposes stricter environmental regulations on the automotive industry, it may increase compliance costs for car manufacturers, affecting their profitability and stock prices.

Unsystematic risk can be reduced or eliminated through diversification by spreading investments across different assets, industries, and geographical regions. By diversifying their portfolios, investors can mitigate the impact of unsystematic risk on their investment returns while still being exposed to systematic risk, which cannot be diversified away.

How to measure Systematic and Unsystematic Risk

While it is challenging to measure risk precisely, there are statistical methods and financial models used to estimate and measure these risks.

Systematic Risk

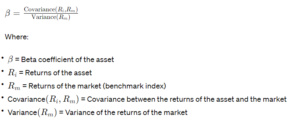

Systematic risk is commonly measured using a statistical metric known as beta (β). Beta measures the sensitivity of an asset’s returns to changes in the overall market. A beta of 1 indicates that the asset’s returns move in line with the market, while a beta greater than 1 suggests higher volatility, and a beta less than 1 indicates lower volatility compared to the market.

The formula to calculate beta is as follows:

Beta can be estimated using historical returns data for the asset and the market index over a specified time period, typically using regression analysis.

Unsystematic Risk

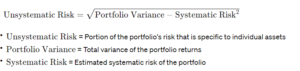

Unsystematic risk can be estimated using statistical measures such as standard deviation, variance, or covariance. These measures help assess the volatility of individual assets or portfolios relative to their expected returns.

In summary, the unsystematic risk formula provides investors with a quantitative measure of the specific risk within a portfolio that can be reduced through diversification. By understanding and managing unsystematic risk, investors can build more resilient portfolios and potentially enhance their risk-adjusted returns.

Why Assess Both Risks?

It’s essential for investors to assess both systematic and unsystematic risks because they have different implications for investment decision-making:

- Systematic risk affects the entire market and cannot be diversified away, so investors need to understand their exposure to market-wide factors.

- Unsystematic risk can be diversified away by holding a diversified portfolio, so investors should aim to mitigate this risk through proper asset allocation and diversification strategies.

By assessing and managing these risks, investors can construct portfolios that align with their risk tolerance, investment objectives, and time horizon, ultimately improving their chances of achieving their financial goals.