What is Profitability Index?

Profitability Index (PI), also known as the Profit Investment Ratio (PIR) or Value Investment Ratio (VIR), is a financial metric used to evaluate the profitability of an investment or project. It measures the relationship between the present value of future cash flows generated by the investment and the initial investment cost. Essentially, it helps in assessing whether an investment will yield positive returns relative to its cost.

The Profitability Index provides valuable insights into the attractiveness of an investment opportunity. A profitability index greater than 1 indicates that the project is expected to generate positive returns, with a higher index value suggesting greater profitability. Conversely, a profitability index less than 1 suggests that the project is unlikely to generate returns that exceed the initial investment cost.

How is Profitability Index Calculated?

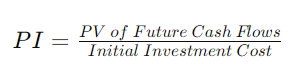

The Profitability Index is calculated by dividing the present value of future cash flows by the initial investment outlay. It can be represented by the following formula:

Where:

- represents the present value of all future cash flows generated by the investment.

- denotes the initial amount invested or the cost of the project.

To calculate the present value of future cash flows, one typically discounts the future cash flows at a predetermined discount rate, usually the project’s required rate of return or Weighted average cost of capital (WACC). The discounting process accounts for the time value of money, as cash received in the future is worth less than cash received today due to factors such as inflation and the opportunity cost of capital.

Example of Profitability Index Calculation

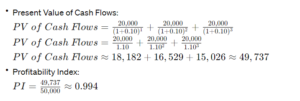

Let’s consider an investment project with an initial outlay of $50,000 and expected cash flows of $20,000 per year for the next three years. Assuming a discount rate of 10%, we can calculate the present value of cash flows and the profitability index as follows:

In this example, the profitability index is approximately 0.994, indicating that the project’s expected returns are slightly lower than the initial investment cost. Therefore, based on the profitability index criterion alone, this investment may not be considered attractive.

Uses of Profitability Index

The Profitability Index (PI) is a valuable financial metric used in various decision-making processes, particularly for capital budgeting and investment analysis. Its primary uses include:

- Capital Budgeting Decisions: One of the primary uses of the Profitability Index is in capital budgeting decisions. Companies often have limited capital resources, and they must choose among various investment opportunities. The PI helps in comparing and selecting the most financially attractive projects by assessing their potential for generating value relative to their initial costs.

- Project Ranking: In situations where a company has multiple investment projects but limited resources, the PI assists in ranking these projects based on their relative profitability. By calculating the PI for each project, managers can prioritize investments and allocate resources to those projects that offer the highest returns per unit of investment.

- Resource Allocation: Effective resource allocation is critical for maximizing shareholder wealth and achieving organizational goals. The PI aids in allocating financial resources efficiently by directing capital towards projects with higher PI values. This ensures that limited resources are allocated to projects that are expected to yield the greatest returns, thereby optimizing the company’s overall investment portfolio.

- Evaluation of Long-term Investments: Profitability Index is particularly useful for evaluating long-term investment projects that involve significant initial outlays and generate cash flows over an extended period. By discounting future cash flows and comparing them to the initial investment cost, the PI provides insights into the long-term profitability and viability of such projects.

- Performance Monitoring: Once an investment project is undertaken, the PI can also be used as a tool for performance monitoring and evaluation. By comparing actual cash flows with initially projected cash flows and recalculating the PI, managers can assess whether the investment is meeting its expected profitability targets or if adjustments are needed to enhance performance.

- Risk Management: While the PI primarily focuses on assessing the profitability of investment opportunities, it indirectly aids in risk management. Projects with higher PI values typically indicate greater potential for generating returns that exceed the initial investment, which may imply lower risk. Conversely, projects with lower PI values may carry higher risk or uncertainty regarding their ability to generate sufficient returns.

Advantages of Profitability Index

The Profitability Index (PI) offers several advantages as a financial metric for evaluating investment opportunities:

- Considers Time Value of Money: The PI accounts for the time value of money by discounting future cash flows back to their present value. This ensures that cash flows received in the future are appropriately adjusted to reflect their current worth, providing a more accurate assessment of investment profitability.

- Comprehensive Evaluation: Unlike simple metrics such as payback period, which only consider the time it takes to recover the initial investment, the PI evaluates the entire stream of cash flows generated by an investment project. This comprehensive analysis enables decision-makers to consider the full financial impact of the investment over its entire duration.

- Allows for Comparison of Projects: The PI facilitates easy comparison of investment projects, regardless of their scale, duration, or initial investment amount. By standardizing the evaluation process, it enables managers to compare projects with different cash flow patterns and investment sizes on a common basis, aiding in the prioritization and selection of the most financially attractive projects.

- Considers All Cash Flows: Unlike metrics such as the internal rate of return (IRR), which may assume reinvestment of cash flows at the project’s IRR, the PI considers all cash flows generated by the investment and does not make any assumptions about reinvestment rates. This ensures that all relevant cash flows are included in the analysis, providing a more accurate measure of investment profitability.

- Alignment with Shareholder Wealth Maximization: The primary goal of most businesses is to maximize shareholder wealth. By assessing investment opportunities based on their potential to generate positive returns relative to their costs, the PI helps in aligning investment decisions with this overarching objective, thereby enhancing shareholder value.

- Facilitates Optimal Capital Allocation: Effective capital allocation is crucial for maximizing returns and optimizing the company’s overall investment portfolio. The PI assists in allocating financial resources efficiently by directing capital towards projects with higher PI values, ensuring that limited resources are deployed to projects that offer the greatest potential for value creation.

- Useful in Long-term Planning: The PI is particularly useful for evaluating long-term investment projects that involve significant initial outlays and generate cash flows over an extended period. By providing insights into the long-term profitability and viability of such projects, it helps in strategic decision-making and long-term planning.

- Easy Interpretation: The concept of the PI is relatively straightforward and easy to understand, making it accessible to a wide range of stakeholders, including managers, investors, and financial analysts. Its simplicity enhances its usability as a decision-making tool in various organizational contexts.

Limitations of Profitability Index

While the Profitability Index (PI) offers several advantages in evaluating investment opportunities, it also has certain limitations that should be considered:

- Dependency on Discount Rate: The PI calculation involves discounting future cash flows back to their present value using a predetermined discount rate, typically the project’s required rate of return or cost of capital. However, the selection of the discount rate is subjective and may vary depending on factors such as risk perception, market conditions, and the company’s cost of capital. Different discount rates can result in different PI values and may lead to inconsistent investment decisions.

- Assumption of Cash Flow Predictability: The accuracy of the PI calculation relies on the accuracy of the cash flow projections used. Estimating future cash flows can be challenging, especially for long-term investment projects with uncertain revenue streams or unpredictable market conditions. Inaccurate cash flow projections can lead to misleading PI values and may result in flawed investment decisions.

- Ignores Project Scale: The PI does not consider the scale or size of the investment project. Consequently, projects with higher initial costs may have lower PI values, even if they have the potential to generate substantial returns over time. This limitation can lead to biased investment decisions favoring smaller projects with higher PI values, neglecting potentially lucrative opportunities that require larger initial investments.

- Limited to Single Investment Projects: The PI is most suitable for evaluating standalone investment projects where the entire cash flow stream can be attributed to a single investment. It may not be applicable for complex projects with multiple stages or interdependent cash flows, such as large-scale development projects or mergers and acquisitions. In such cases, alternative valuation methods or adjustments to the PI calculation may be necessary.

- Does Not Account for Project Duration: The PI does not explicitly consider the duration of the investment project. Consequently, projects with shorter durations may appear more attractive than longer-term projects, even if the latter offer higher total returns over their lifetime. This limitation can lead to suboptimal investment decisions, particularly in industries where long-term investments are prevalent.

- Subject to Manipulation: Like any financial metric, the PI can be susceptible to manipulation or misinterpretation. Managers may attempt to artificially inflate PI values by adjusting cash flow projections or discount rates to justify investment decisions. Additionally, the PI may not capture qualitative factors such as strategic alignment, market dynamics, or competitive advantages, which are essential considerations in investment analysis.

- Not Suitable for Comparing Projects with Different Lives: When comparing investment projects with different economic lives, the PI may not provide an accurate basis for comparison. Projects with longer durations tend to have higher total cash flows, which can distort the PI calculation and lead to biased investment decisions. In such cases, alternative metrics such as the equivalent annual annuity (EAA) or modified internal rate of return (MIRR) may be more appropriate.

Despite these limitations, the Profitability Index remains a valuable tool for evaluating investment opportunities and guiding capital allocation decisions. However, it should be used in conjunction with other financial metrics and qualitative factors to ensure a comprehensive and robust investment analysis.