Valuation multiples play a crucial role in the corporate finance, providing analysts and consultants with valuable insights into the market’s perception of a company’s worth. In this article, we will delve into the definition of valuation multiples, explore the different types, understand the calculation methodologies with examples, and discuss the advantages and limitations of using multiples in the valuation process.

What are Valuation Multiples?

Valuation multiples are financial metrics used to assess the value of a company relative to a specific financial variable. They offer a quick and effective way to compare companies within the same industry or sector, aiding analysts, executives etc. in making informed decisions.

Types of Equity Multiples

There are two types of multiples generally used to compare valuation of Companies in the same or different industries. Equity Multiples and Enterprise Value (EV) Multiples.

In this article we will discuss the different types of Equity multiples

Book Value Multiple (P/B) Ratio :

The Book Value Multiple is a financial metric that compares a company’s market value (market capitalization) to its book value. The book value of a company is essentially its net asset value, calculated by subtracting total liabilities from total assets. This metric is also known as the Price-to-Book (P/B) ratio.

The formula for calculating the Book Value Multiple is as follows:

Market capitalization = Share Price x Total outstanding shares of the Company

Book Value=Total Assets−Total Liabilities

Example – if a company’s stock is trading at $60 per share, and its book value per share is $30, the Book Value Multiple would be 2x ($60/$30). This implies that the market values the company’s assets at twice their book value.

It’s important to note that the Book Value Multiple has its limitations. It may not be as meaningful for companies with significant intangible assets, as these may not be fully reflected in the book value. Additionally, the multiple does not consider future growth prospects, earnings potential, or qualitative factors, so it is often used in conjunction with other valuation metrics for a more comprehensive analysis.

2. Price to Sales Ratio (P/S) Ratio : The Price-to-Sales (P/S) ratio is a financial metric that compares a company’s market capitalization to its total revenue. It is a valuation ratio that investors and analysts use to assess how the market values a company’s stock in relation to its sales.

The formula for calculating the Price-to-Sales ratio is as follows:

Market capitalization = Share Price x Total outstanding shares of the Company

Total Revenues is reported or expected 12 months sales

The Price-to-Sales ratio provides insights into how much investors are willing to pay for each dollar of a company’s revenue. A higher P/S ratio may indicate that investors are expecting strong future revenue growth, while a lower ratio may suggest that the market has lower growth expectation.

Example – If a company’s market capitalization is $4000 Million, and its revenue is $1,000 Million, the Price-to-Sales ratio would be 4x ($4000/$1000). This implies that investors are willing to pay four times price for the company’s annual revenue.

Unlike the Price-to-Earnings (P/E) ratio, the P/S ratio does not take into account a company’s profitability. Therefore, it is important to use it in conjunction with other valuation metrics for a more comprehensive analysis.

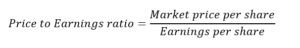

3. Price-to-Earnings (P/E) Ratio : The Price-to-Earnings (P/E) ratio is a widely used financial metric that compares a company’s market price per share to its earnings per share (EPS). It is a valuation ratio that provides insights into how the market values a company’s stock in relation to its earnings.

The formula for calculating the Price-to-Earnings ratio is as follows:

Market Price per Share is the current trading price of a company’s stock.

Earnings per Share (EPS) is the company’s net income divided by the number of outstanding shares.

The P/E ratio is a crucial tool for investors and analysts, offering a quick way to assess the relative value of a stock compared to its earnings. There are two main types of P/E ratios: trailing P/E and forward P/E.

Trailing P/E Ratio uses the company’s historical earnings from the past 12 months.

Trailing P/E Ratio = Current market price per share/ Trailing 12 months EPS

Forward P/E Ratio uses the company’s estimated future earnings.

Forward P/E Ratio = Current market price per share/ Next 12 months expected EPS

Example, if a company’s stock is trading at $50 per share, and its trailing twelve months EPS is $5, the trailing P/E ratio would be 10x ($50/$5). This implies that investors are willing to pay 10 times the company’s past earnings for one share of its stock.

A high P/E ratio may indicate that investors expect strong future earnings growth, while a low ratio may suggest lower growth expectations. P/E ratio may differ by industries. P/E ratio for technology Companies is generally higher than Commodity Companies (Chemicals, Metals etc.) due to difference in growth prospects.

While the P/E ratio is a valuable tool, it has its limitations, and investors should use it in combination with other financial metrics and qualitative analysis for a more thorough assessment of a company’s investment potential.

Advantages of using Equity based valuation multiples

- Multiples enable a quick and effective comparative analysis. By comparing a company’s valuation metrics, such as P/E or P/S ratios, to those of its peers or industry benchmarks, investors can gain insights into how the market values different companies within the same sector.

- Multiples are relatively easy to calculate and understand, making them accessible to a broad range of stakeholders.

- Equity multiples are particularly useful for benchmarking against industry averages or standards.

- The P/E ratio, especially the forward P/E ratio, can serve as a forward-looking indicator. Investors use this metric to assess the market’s expectations for a company’s future earnings growth.

- Multiples enable a quick screening process for potential investments. Investors can use these ratios to filter and prioritize stocks based on their valuation relative to financial performance metrics.

Limitations of Using Equity based valuation Multiples

- Multiples may not provide a comprehensive picture of a company’s financial health as they often lack context about industry dynamics, growth prospects, and qualitative factors.

- Equity multiples (P/E multiple) are impacted by non-operating income and expenses and financing decisions. Therefore, two Companies having different finance structure and same operating performance may differ in their P/E multiples.

- Relying solely on multiples may lead to oversimplification, overlooking unique characteristics of a company that are not captured in quantitative metrics.

- Differences in accounting methods can impact multiples, leading to variations in valuation results

Conclusion

Valuation multiples are invaluable tools for analysts, consultants; offering a snapshot of a company’s valuation in comparison to peers. While their simplicity and ease of use make them attractive, it’s essential for analysts to balance their analysis by considering the advantages and limitations associated with different multiples. By understanding the nuances of each multiple and applying them judiciously, they can enhance their ability to make well-informed and nuanced valuation assessments.

Pingback: Unveiling the Power of Enterprise Value Multiples - corpfinanceinsights.com

Pingback: Total Shareholders Return (TSR) - corpfinanceinsights.com