Introduction

In the dynamic landscape of financial analysis, Enterprise Value Multiples emerge as crucial metrics for valuation consultants seeking a holistic understanding of a company’s worth. In this article, we will explore what Enterprise Valuation Multiples are, delve into different types, understand their calculation methodologies with examples, and discuss the advantages and limitations of employing these multiples in the valuation process.

What are Enterprise Value Multiples?

Enterprise Value Multiples are financial metrics used to evaluate a company’s overall value, considering both its equity and debt components. Unlike equity-based multiples that focus solely on a company’s stock, Enterprise Valuation Multiples provide a more comprehensive picture by incorporating debt and other liabilities into the valuation equation. This approach offers a nuanced view of a company’s true enterprise value.

Types of Enterprise Valuation Multiples:

1. Enterprise Value-to-Revenue (EV/Revenue):

The EV/Revenue multiple, also known as the Enterprise Value-to-Revenue multiple, is a financial metric used in valuation to assess a company’s valuation by comparing its enterprise value to its total revenue. This multiple provides insights into how the market values a company’s sales or revenue relative to its overall enterprise value. It is particularly useful for analysts and investors interested in understanding how a company’s revenue performance is perceived in the market.

The EV/Revenue multiple provides a straightforward way to assess a company’s valuation based on its top-line revenue. This can be particularly useful for companies in early stages or industries where revenue growth is a key driver of valuation.

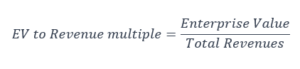

The EV/Revenue multiple is calculated as follows:

Where:

- Enterprise Value (EV) is the total value of a company’s equity and debt.

- Revenue is the total income generated by the company.

Example: Company XYZ

- Current Market Cap : $100 million

- Total Debt: $60 million

- Cash: $10 million

- Revenue: $50 million

EV = Current Market Cap + Total Debt – Cash

EV = 100 + 60 – 10 = 150 million

EV to Revenue multiple = 150/50 = 3x

This implies that, based on the company’s enterprise value and revenue, investors are willing to pay three times the company’s annual revenue for its entire enterprise.

2.Enterprise Value-to-EBITDA (EV/EBITDA)

The EV/EBITDA multiple, also known as the Enterprise Value-to-EBITDA multiple, is a financial metric used to assess the valuation of a company by comparing its enterprise value to its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). This multiple provides insights into how the market values a company’s operating performance without the influence of financing decisions, taxes, or non-cash expenses.

EBITDA is a measure of a company’s operating performance, excluding interest, taxes, and non-cash items. The EV/EBITDA multiple focuses on this key indicator, providing a cleaner view of a company’s core profitability.

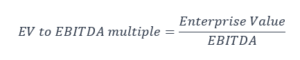

The formula for calculating the EV/EBITDA multiple is as follows:

Where:

- Enterprise Value (EV) is the total value of a company’s equity and debt.

- EBITDA is the company’s Earnings Before Interest, Taxes, Depreciation, and Amortization.

Example: Company XYZ

- Current Market Cap : $100 million

- Total Debt: $60 million

- Cash: $10 million

- EBITDA: $30 million

EV = Current Market Cap + Total Debt – Cash

EV = 100 + 60 – 10 = 150 million

EV to EBITDA multiple = 150/30 = 5x

This implies that, based on the company’s enterprise value and EBITDA, investors are willing to pay five times the company’s EBITDA for its entire enterprise.

3. Enterprise Value-to-EBIT (EV/EBIT)

The EV/EBIT (Enterprise Value-to-Earnings Before Interest and Taxes) multiple is a financial metric used in valuation to assess a company’s valuation by comparing its enterprise value to its Earnings Before Interest and Taxes (EBIT). This multiple provides insights into how the market values a company’s operating earnings relative to its overall enterprise value, excluding the impact of taxes and financing decisions.

EBIT is a measure of a company’s operating earnings, and the EV/EBIT multiple provides a cleaner view of a company’s core profitability, excluding the impact of taxes and financing decisions.

Since EBIT is less affected by variations in accounting practices, the EV/EBIT multiple is useful for comparing companies across different industries, providing insights into how the market values operating earnings in specific sectors. The EV/EBIT multiple is commonly used in merger and acquisition (M&A) transactions as it provides a comprehensive view of a company’s value based on its operating earnings.

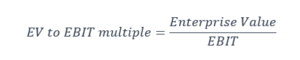

The formula for calculating the EV/EBIT multiple is as follows:

Where:

- Enterprise Value (EV) is the total value of a company’s equity and debt.

- EBIT is the company’s Earnings Before Interest and Taxes.

Example: Company XYZ

- Current Market Cap : $100 million

- Total Debt: $60 million

- Cash: $10 million

- EBIT: $20 million

EV = Current Market Cap + Total Debt – Cash

EV = 100 + 60 – 10 = 150 million

EV to EBIT multiple = 150/20 = 7.5x

In this example, the EV/EBIT multiple is 7.5x. This implies that, based on the company’s enterprise value and EBIT, investors are willing to pay 7.5 times the company’s EBIT for its entire enterprise.

4. Enterprise Value-to-EBIT (EV/NOPAT)

The EV/NOPAT (Enterprise Value-to-Net Operating Profit After Tax) multiple is a financial metric used in valuation to assess a company’s worth by comparing its enterprise value to its Net Operating Profit After Tax (NOPAT). This multiple provides insights into how the market values a company’s operating profitability after taxes .

NOPAT represents a company’s operating profitability after accounting for taxes. The EV/NOPAT multiple provides a cleaner view of a company’s core operating performance, excluding the impact of capital structure. By including taxes in the NOPAT calculation, the EV/NOPAT multiple accounts for the tax impact on operating profits.

The EV/NOPAT multiple is valuable in merger and acquisition (M&A) transactions as it provides a comprehensive view of a company’s value based on its operating profitability, considering both taxes and capital structure.

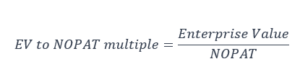

The formula for calculating the EV/NOPAT multiple is as follows:

Where:

- Enterprise Value (EV) is the total value of a company’s equity and debt.

- NOPAT is the Net Operating Profit After Tax.

Let’s break down the components and understand how to calculate the EV/NOPAT multiple with an example:

Example: Company XYZ

- Current Market Cap : $100 million

- Total Debt: $60 million

- Cash: $10 million

- NOPAT: $15 million

EV = Current Market Cap + Total Debt – Cash

EV = 100 + 60 – 10 = 150 million

EV to NOPAT multiple = 150/15 = 10x

In this example, the EV/NOPAT multiple is 10x. This implies that, based on the company’s enterprise value and NOPAT, investors are willing to pay 10 times the company’s net operating profit after tax for its entire enterprise.

Check Enterprise value multiples by industries

Advantages of Enterprise Value Multiples

- Comprehensive Valuation: Enterprise Value multiples provide a comprehensive view of a company’s overall value by considering both equity and debt. This holistic approach is particularly relevant in merger and acquisition (M&A) scenarios where the entire enterprise is often the subject of the deal.

- Debt Consideration: EV multiples incorporate a company’s debt, providing a more accurate representation of its financial health compared to equity-based multiples. This is crucial for understanding the total cost of acquiring a business, including its debt obligations.

- Comparative Analysis: Enterprise Value multiples are useful for comparative analysis, allowing investors to compare a company’s valuation metrics to those of its peers or industry averages. This helps in identifying relative strengths and weaknesses in terms of valuation.

- Operating Performance Focus: Metrics like EV/EBITDA and EV/NOPAT focus on a company’s operating performance, excluding the impact of interest and non-operating items. This provides a clearer picture of a company’s core profitability.

- Useful in M&A Transactions: EV multiples are widely used in M&A transactions as they provide a comprehensive valuation of the entire business, considering both operating performance and debt obligations.

Limitations of Enterprise Value Multiples

- Industry-Specific Challenges: Different industries have different taxes, capital structures and financial dynamics. Using the same EV multiple across diverse industries may not account for these variations, leading to potentially inaccurate comparisons (For example using EV/EBITDA or EV/EBIT multiple for Oil and gas companies might not give the correct picture as taxes structure in the oil and gas industry differ by geographies).

- Not Applicable for All Businesses: EV multiples may be less useful for companies in banking and financial services industry. Equity based multiples are more useful in these industries.

- Does Not Capture Growth Prospects: EV multiples, particularly those based on historical financials, may not fully capture a company’s growth prospects. Investors may need to complement EV multiples with other metrics, such as discounted cash flow (DCF) analysis, to assess future growth potential.

Enterprise Value Multiples serve as invaluable tools for consultants seeking a comprehensive understanding of a company’s worth. By incorporating both equity and debt components, these multiples offer a more nuanced perspective on valuation. While their advantages include debt consideration and cross-industry comparability, consultants should be mindful of their limitations and employ these multiples judiciously. Ultimately, a well-rounded valuation analysis integrates multiple metrics and qualitative factors to provide a holistic view of a company’s financial standing.