Efficient cash flow management is essential for the sustained success of any business. One key metric that provides valuable insights into a company’s operational efficiency and financial health is the Cash Conversion Cycle (CCC). In this article, we will explore what the CCC is, how it is calculated, delve into its components, and discuss strategies for companies to enhance and optimize their cash conversion cycles.

What is Cash Conversion Cycle?

The Cash Conversion Cycle (CCC) is a financial metric that measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. It is a key indicator of a company’s efficiency in managing its working capital and liquidity. The CCC is expressed in terms of days and provides insights into the company’s operational efficiency and cash flow management.

How is Cash conversion cycle calculated?

The Cash Conversion Cycle is calculated using the following formula

![]()

Where:

DIO is Days of Inventory Outstanding. It Represents the average number of days it takes for a company to sell its entire inventory. DIO measures how efficiently a company manages its inventory. A lower DIO suggests faster inventory turnover and more efficient inventory management.

It is calculated as the ratio of average inventory to the cost of goods sold (COGS) per day.

DSO is Days of Sales Outstanding. It indicates the average number of days it takes for a company to collect payment after making a sale. DSO measures the efficiency of a company’s credit and collection policies. A shorter DSO indicates that the company is collecting payments from customers more quickly.

It is calculated as the ratio of accounts receivable to the total credit sales per day.

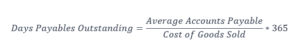

DPO is Days Payable Outstanding. It represents the average number of days it takes for a company to pay its suppliers. DPO measures how quickly a company pays its suppliers. A longer DPO implies that the company is taking more time to settle its payables, effectively using the supplier’s credit terms.

It is calculated as the ratio of accounts payable to the cost of goods sold (COGS) per day.

Importance of Cash Conversion Cycle

-

- Measure of Working Capital Efficiency: The CCC is a key indicator of a company’s ability to manage its working capital efficiently. A shorter CCC generally signifies improved working capital management.

- Liquidity and Financial Health: A shorter CCC results in faster conversion of assets into cash, enhancing liquidity and overall financial health of the Company.

- Cost Savings: Shorter CCC also positively impacts the profitability of Companies, by reducing the inventory carrying cost and short term financing costs. A well-managed CCC can lead to cost savings by minimizing financing needs and reducing interest expenses associated with working capital.

Strategies for Improving the Cash Conversion Cycle

- Optimize Inventory Management: Regularly review and adjust inventory levels to match demand, avoiding overstocking or stockouts. Implement just-in-time inventory practices to enhance efficiency.

- Streamline Accounts Receivable Processes: Corporates can streamline accounts receivable by Implementing efficient invoicing systems, offering discounts to customers for early payments, and establish robust credit policies to reduce DSO and accelerate cash collection.

- Negotiate Favourable Payment Terms with Suppliers: Managing DPO is equally important as DIO and DSO. Negotiate extended payment terms with suppliers without negatively impacting relationships. This can enhance DPO and provide additional time to convert inventory into sales

- Utilize Technology for Automation: Leverage technology and automation tools to streamline financial processes, reducing the time required for invoicing, payments, and inventory tracking.

- Enhance Communication with Suppliers and Customers: Corporates should aim to establish clear communication channels with both suppliers and customers to ensure smooth transactions, minimize disputes, and facilitate faster processing of orders and payments

In conclusion, the Cash Conversion Cycle is a critical metric for businesses aiming to optimize their working capital and improve overall financial performance. By understanding the components of the CCC and implementing strategic measures to reduce the cycle time, companies can enhance liquidity, reduce financing costs, and position themselves for sustainable growth in today’s competitive business landscape. Implementing these strategies can lead to improved cash flow management and increased operational efficiency for corporates.

References:.Mckinsey & Company – Uncovering cash and insights from working capital

Pingback: 10 steps to reduce Days Sales Outstanding (DSO) - corpfinanceinsights.com

Pingback: KPIs to optimize Inventory Management - corpfinanceinsights.com

Pingback: Key KPIs for Effective DSO Management - corpfinanceinsights.com

Pingback: Accounts Payable Management: Strategies for Enhanced Cash Flow and Vendor Relations - corpfinanceinsights.com

Pingback: 10 KPIs for Effective Accounts Payables Management - corpfinanceinsights.com

Pingback: Understanding Negative Cash Conversion Cycle: Implications and Examples